A Guide for Future Investors

Introduction

Your life could be changed by real estate investing, but knowing when to get started can be difficult. One of the numerous factors that affects the real estate market is time, which will determine whether or not your investment is successful. When to start investing in real estate depends on a number of factors, including market conditions, economic trends, and individual financial readiness. If you want to earn passive income, build equity, or amass long-term wealth, the world of real estate investing provides a wide variety of alternatives. However, timing is a crucial element that can have a big impact on the results of your investments. Your earnings can be maximized and you can start down the road to financial success if you decide to invest in real estate at the proper time.

In this comprehensive Real Estate Investing Wizards blog, we will delve deeper into the important factors to consider when deciding when to start real estate investing. We will explore financial readiness, market analysis, risk tolerance, long-term vision, and market cycles. By examining these factors in detail, you will gain valuable insights to make informed decisions and seize opportunities in the real estate market. Remember, real estate investing is not a one-size-fits-all approach, and there is no definitive answer to the question of when is the best time to start. It’s crucial to conduct thorough research, seek expert advice, and evaluate your personal circumstances to determine the optimal timing for your real estate investment journey. So, let’s dive in and explore the intricacies of real estate investing, empowering you to make wise decisions and embark on a path to financial success.

Timing Considerations

Beyond the broad notion of purchasing low and selling high, timing considerations are also important. Interest rates, supply and demand dynamics, as well as monetary policy, all have an impact on real estate markets. You may put yourself in the best possible position for real estate investing success by comprehending these market forces and spotting advantageous circumstances. The state of the economy is one important consideration. Economic trends that affect the real estate market include salary growth, job creation, and GDP expansion. Property values may rise and demand for homes may surge during times of economic expansion. On the other side, economic downturns can offer chances to buy properties for less money which is why savvy investors prefer to invest during economic downtowns opposed to buying when everyone else is having a bidding war over properties. You can assess the overall health of the real estate industry and make wise investment choices by keeping an eye on economic indicators.

Financial Readiness

The preparation of your personal finances is also a crucial factor. Prior to getting started with real estate investing, it is crucial to evaluate your financial condition, including your savings, income stability, and creditworthiness. It’s critical to comprehend your spending plan, financial objectives, and risk tolerance clearly. You can use this self-assessment to help you decide which types of properties and investing techniques are best for your financial situation. Depending on your particular situation and ambitions, each person will have a different idea of when is the best time to start investing in real estate. Some investors could choose to invest during recessionary times when property prices are lower and there is less competition. Others might look for possibilities in developing economies with long-term appreciation potential. The ideal moment beginning your real estate investing journey will depend on your investment schedule, risk tolerance, and desired goals.

Considerations

To recap, the key factors you should consider when deciding if and when you are ready to begin investing in real estate are:

- Financial Health & Wellness

- Market Analysis

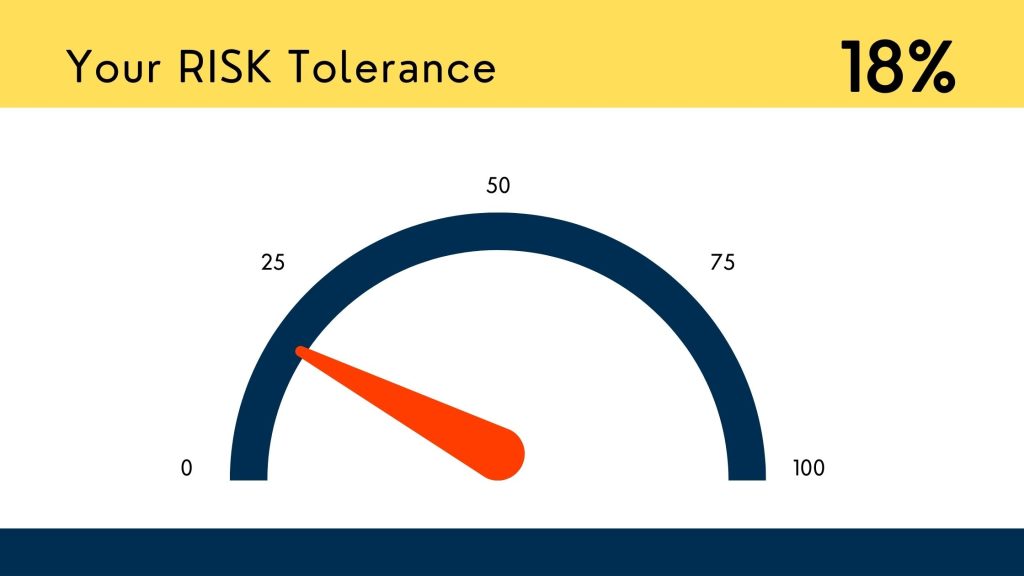

- Risk Tolerance

- Long Term Vision

- Market Cycles

- Expert Advise

- Education and Continuous Learning

Financial Health & Wellness

The first stage in real estate investing is to evaluate your financial fitness. Consider your income, savings, and credit score while assessing your present financial status. To determine your affordability, decide on your investment goals and make a thorough budget. To make sure your decisions are well-informed and in line with your financial goals, you can also think about speaking with a financial counselor.

Market Analysis

Before making an investment, it is important to understand the real estate market. Perform in-depth research on demand-supply dynamics, property prices, rental rates, and market trends in your area. Analyze the target area’s economic data, job trends, population expansion, and development goals. Your investment decisions will be guided by the information provided in identifying new trends and potential business prospects.

Risk Tolerance

Determining your level of risk tolerance is important when thinking about real estate investment. Establish your level of tolerance for market, vacancy, and possible revenue variations. Think about diversifying your portfolio by making investments in various types of real estate, regions, and tactical approaches. To preserve your investment, look at risk mitigation techniques like insurance and backup plans.

Long Term Vision

Investing in real estate requires a long-term commitment, so having a distinct vision is essential. Establish your investment objectives, whether they are to fund retirement, increase equity, or generate passive income. Consider matching the investment’s time span to your financial aims and personal goals. Real estate is a desirable alternative for wealth creation since it can provide stability and long-term growth.

Market Cycles

There are expansion, stability, recession, and recovery cycles in the real estate market. Though it might be difficult to time the market exactly, knowing the phases can assist guide your investment approach. In a downturn, you might come across foreclosed homes or strike advantageous agreements. Property values may rise quickly during an upswing, but competition may also rise. Be adaptable in your investment strategy and your approach to the market.

Expert Advice

Consulting real estate experts can greatly improve your experience as an investor. Consult with seasoned brokers, agents, and investment consultants who are well-versed in the regional market. They may offer insightful advice, support you in locating profitable prospects, and direct you through the investment process. Additionally, interacting with other investors can open up new insights and business opportunities.

Education and Continuous Learning

Investing in real estate necessitates continual learning and being current with industry trends. Attend conferences, workshops, and seminars to increase your expertise and acquire perspective from business leaders. Learn more about real estate investing tactics, financing choices, and risk management strategies by exploring internet resources, books, and podcasts. You will have the knowledge and tools to make wise decisions about your investments if you continue to learn.

Conclusion

The optimal timing to begin investing in real estate is a personal choice that is influenced by a number of factors. It necessitates considerable consideration, financial readiness, and a distinct understanding of your objectives. Keep in mind that the real estate market is dynamic and constantly changing, so staying informed is crucial. You may confidently traverse the real estate investment landscape by being aware of your financial readiness, analyzing the market, and getting professional advice. Unlock the wealth-building potential of real estate investing by starting your journey right now.